Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

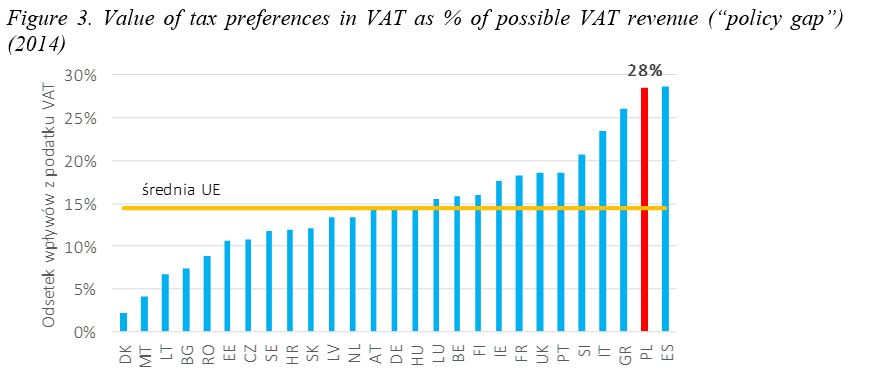

Study and Reports on the VAT Gap in the EU-28 Member States - CASE - Center for Social and Economic Research

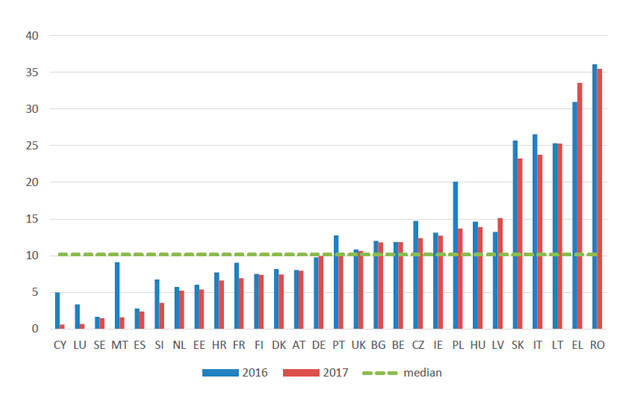

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

The Revenue Administration-Gap Analysis Program in: Technical Notes and Manuals Volume 2017 Issue 004 (2017)