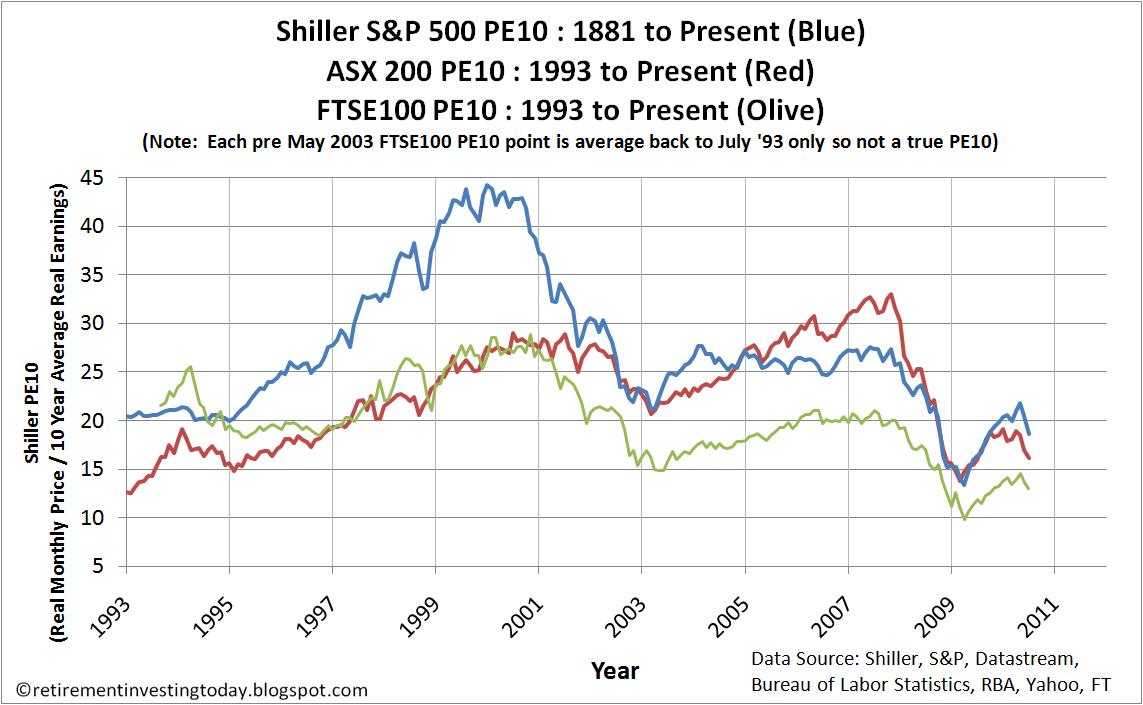

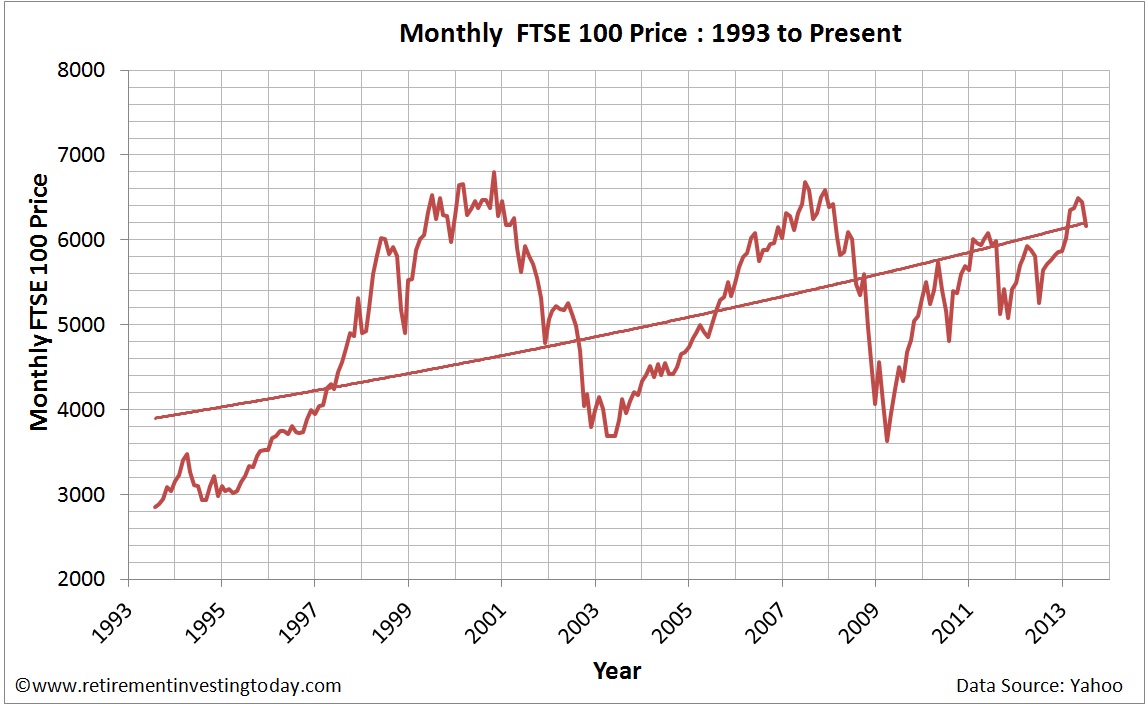

Retirement Investing Today: The FTSE 100 cyclically adjusted PE ratio (FTSE 100 CAPE or PE10) – May 2011

Retirement Investing Today: The FTSE 100 Cyclically Adjusted Price Earnings Ratio (FTSE 100 CAPE) Update - June 2013

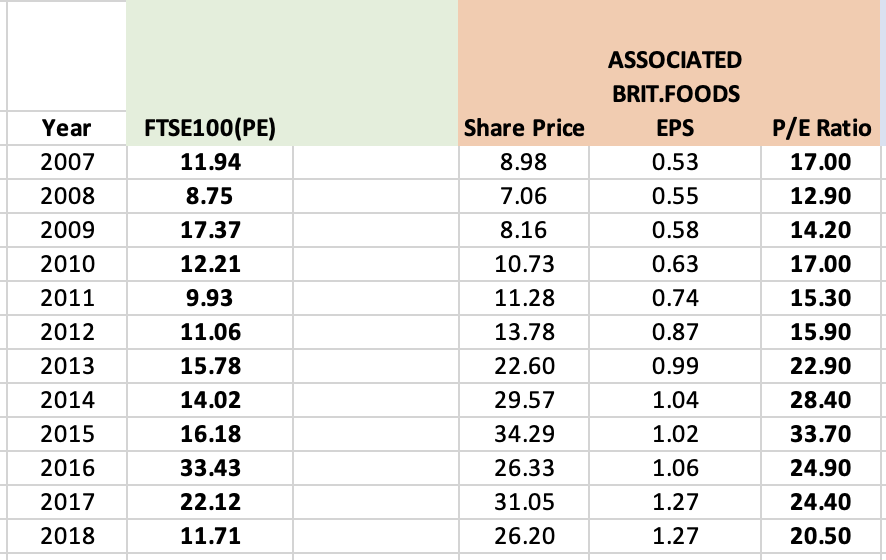

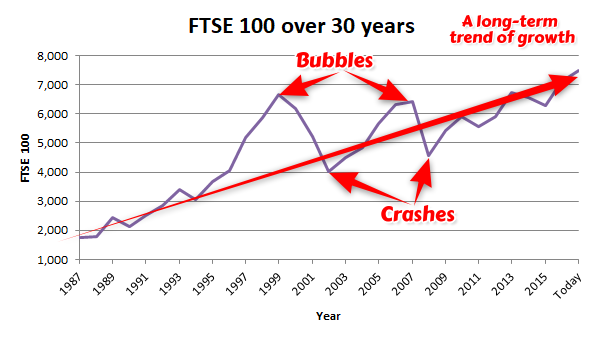

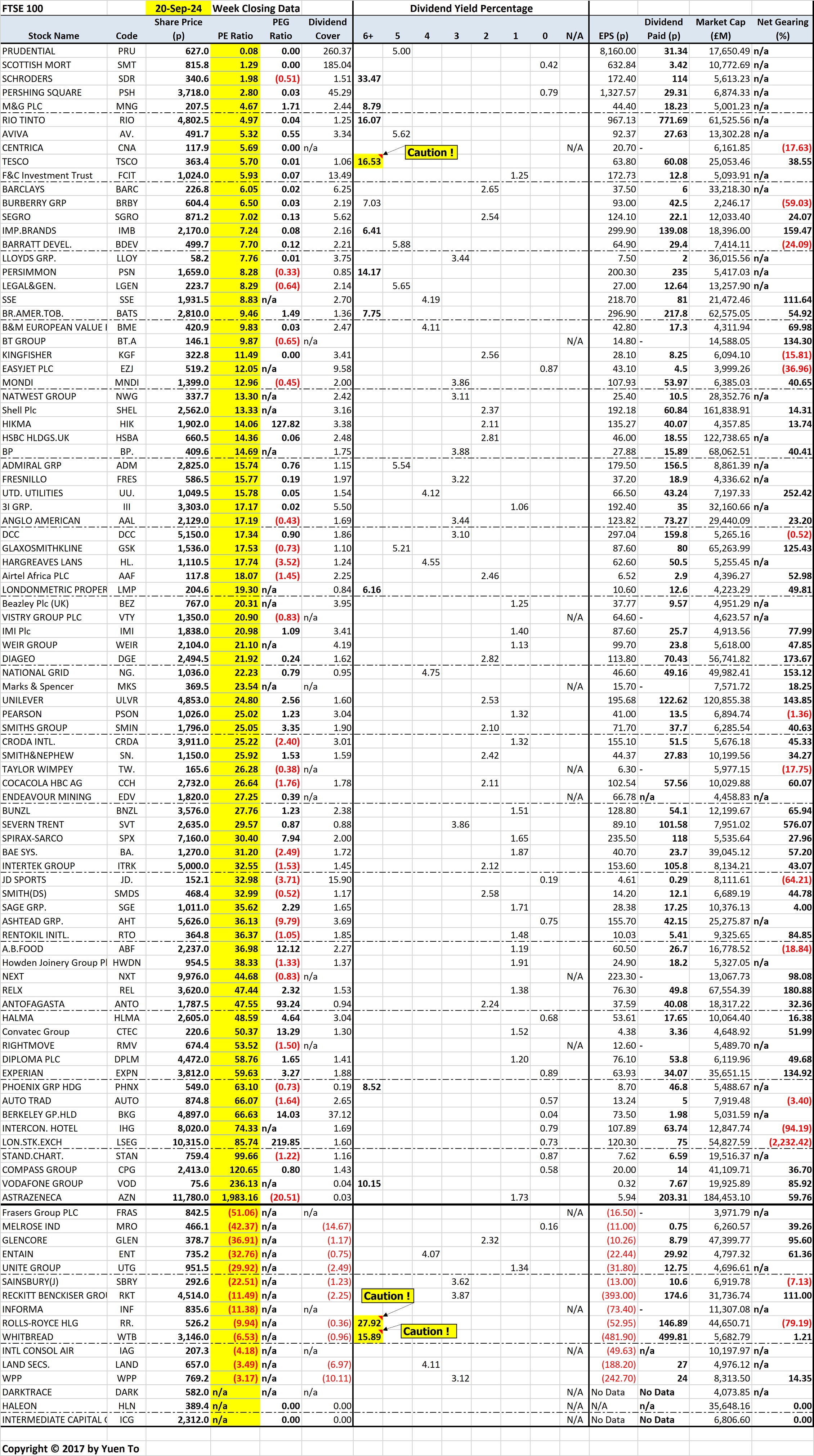

The 17.6 Year Stock Market Cycle: Historic FTSE 100 Trailing Price Earnings (PE) Ratio - Updated 07062017