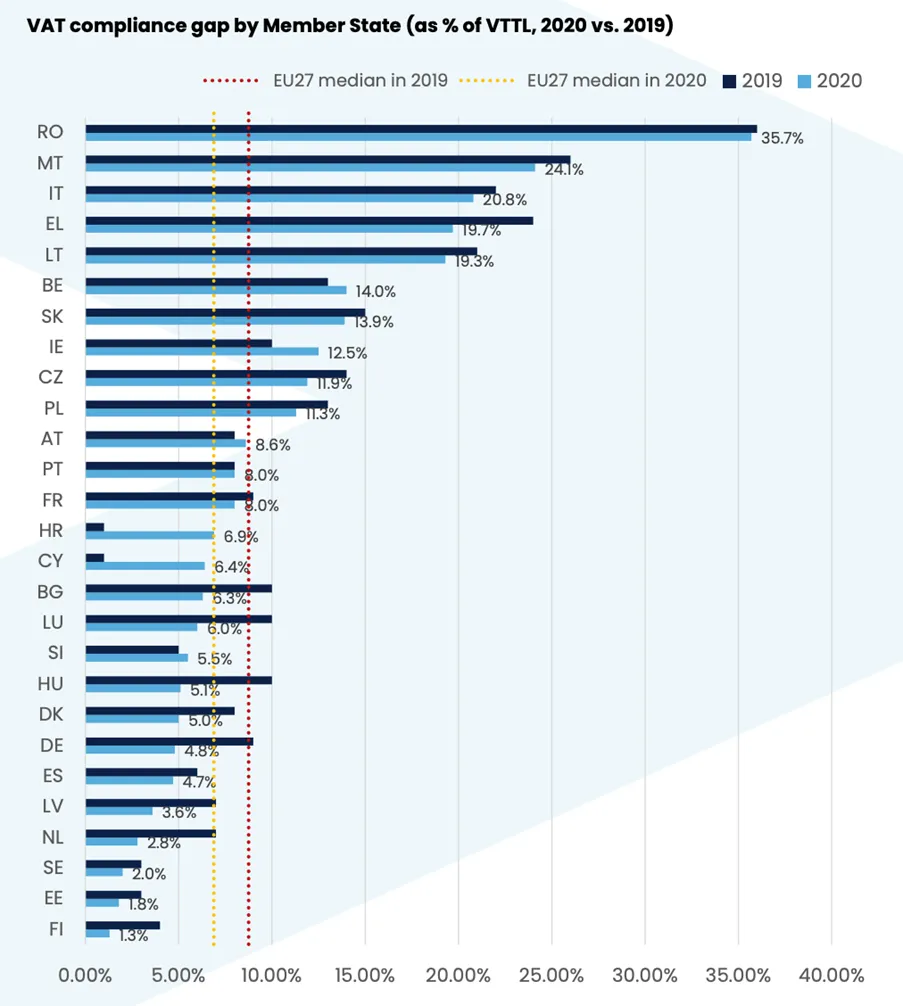

VAT Gap in Poland: policy problem and policy response The goal of proposed research project is to comprehensively examine the ev

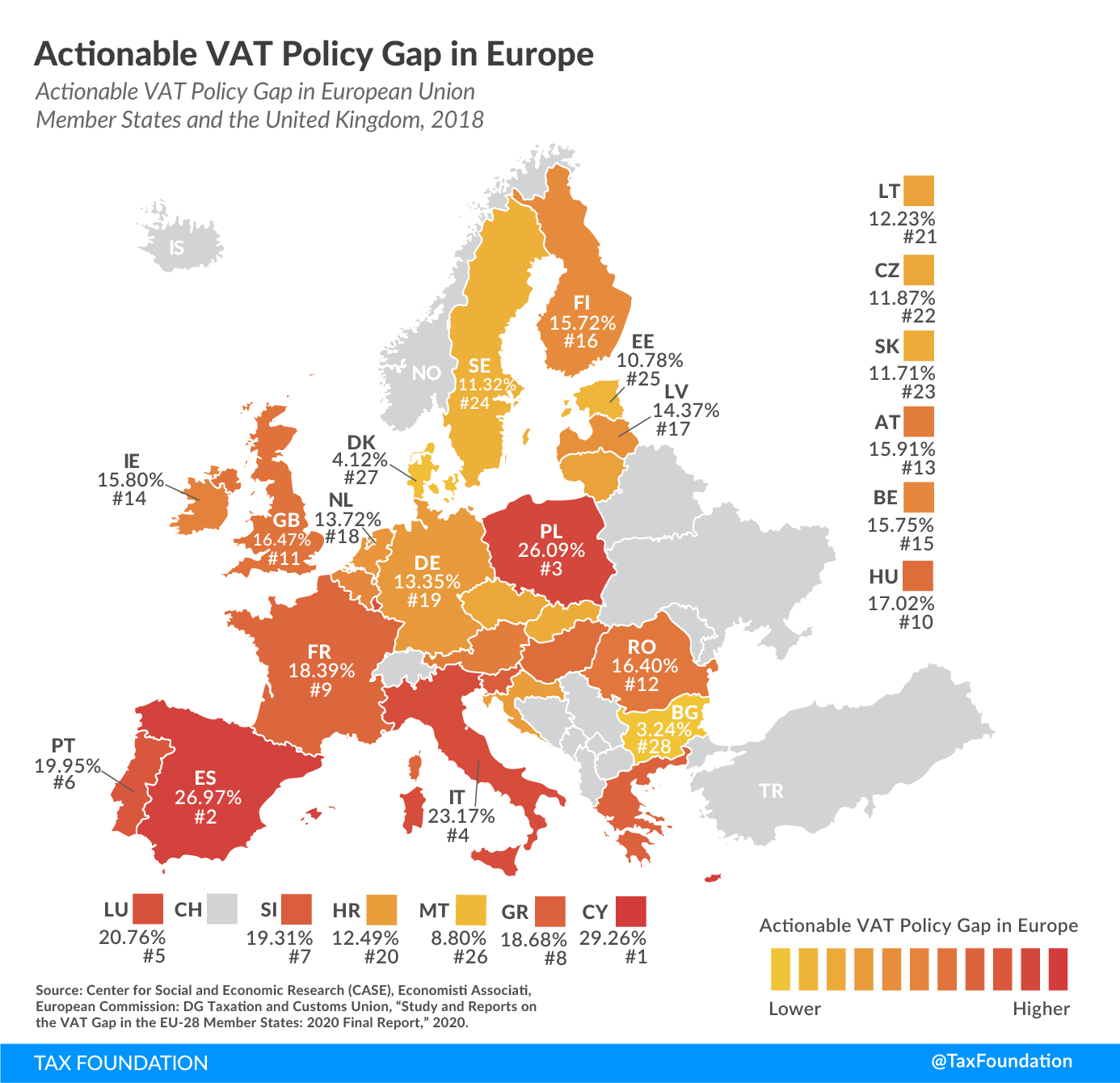

ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile

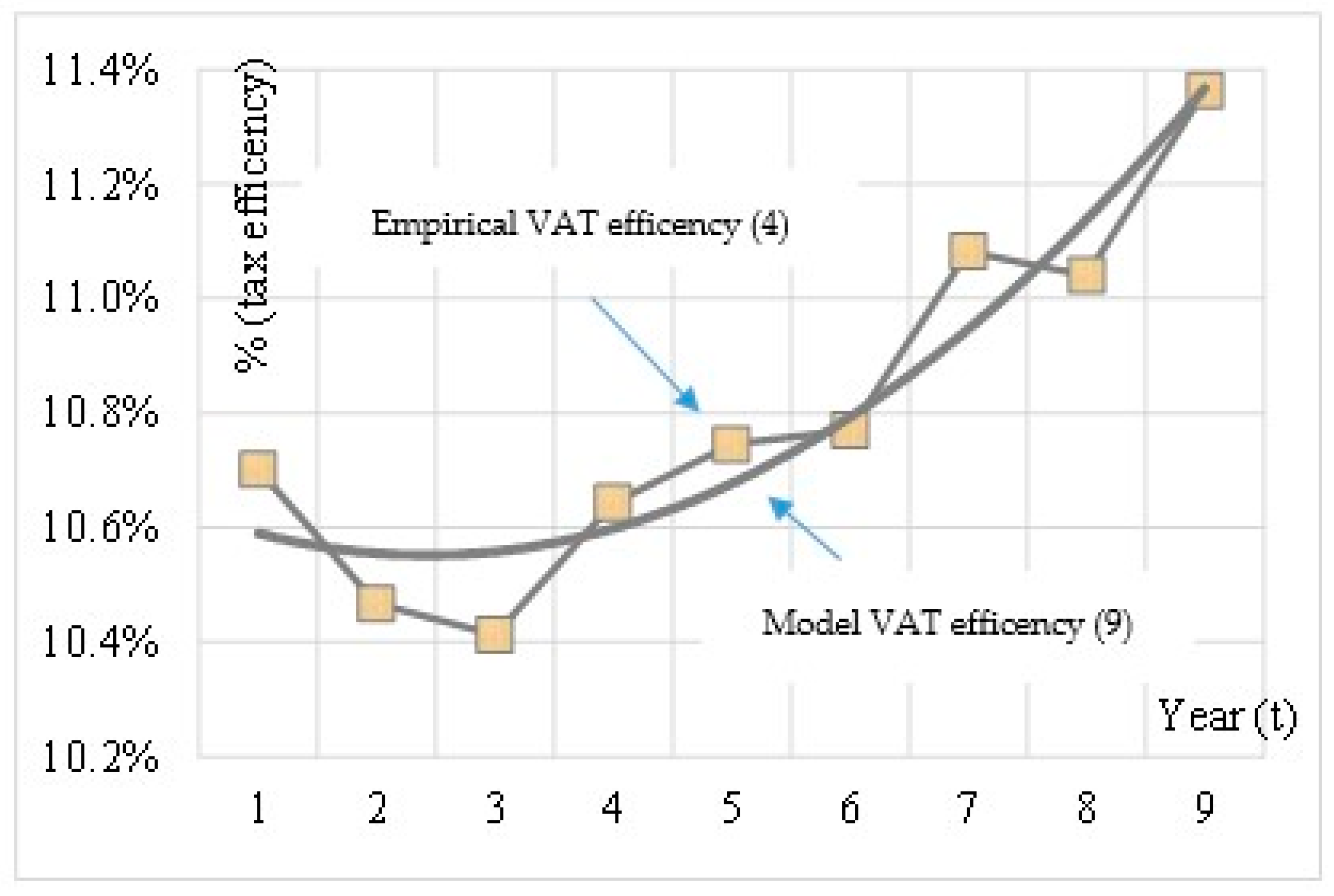

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union